| 2020 HSFO-MGO price differential likely to rise, but scrubber case still uncertain | |||

|---|---|---|---|

본문

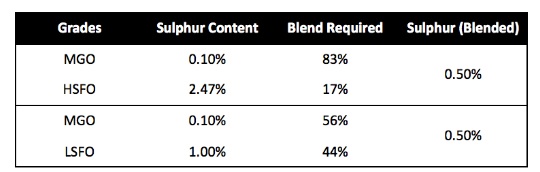

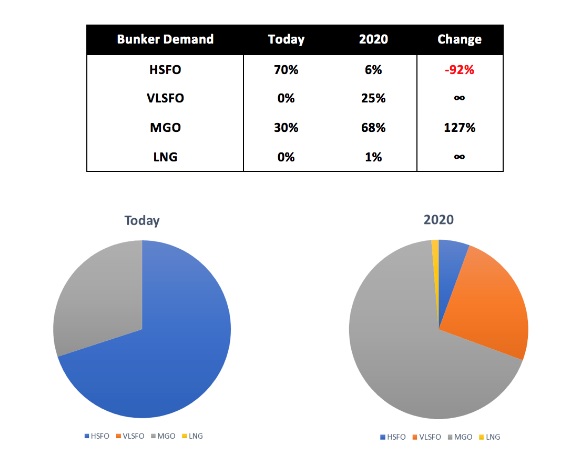

Ishaan Hemnani from BunkerEx has investigated where existing 3.5% HSFO bunker demand will go, how this will be replaced and what this means for prices. The future cost of 3.5% HSFO could go as low as $220 per metric ton. The only markets left for 3.5% HSFO are power generation, which currently uses LNG and coal (approximately $114/mt). In order to compete, 3.5% HSFO will need to be priced at parity with LNG and coal which results in a price of approximately $220/mt. Even with the uptake in retrofit scrubber demand and the widespread installation on newbuilds, the most optimistic figures indicate that 3,800 ships will have scrubbers by 2020. Various estimates put 3.5% HSFO demand from scrubbers anywhere from 5-33% of total bunker demand (300-1,050kbpd) meaning at best 66% of 3.5% HSFO bunker demand will disappear (assuming full compliance). 1% LSFO, although not compliant itself will be blended with 0.1% MGO to create a 0.5% VLSFO. The demand for 1% LSFO is already reflected in the high spread vs 3.5% HSFO. Even using a [technically incorrect] assumption that sulphur blends linearly, the mixes required to turn a 2.47% HSFO (global average) to 0.5% would be 83% of MGO and 17% of HSFO.

Therefore the use cases for 3.5% HSFO are low outside of power generation and it’s difficult to see any support for prices of high sulphur products. The cost of 0.1% MGO could go as high as $900/mt from current levels. This is not just because more ships will run on 0.1% MGO but also for its use in blending to a 0.5% VLSFO (see table above). Several majors have already announced they will have 0.5% VLSFO blends available in the major ports, however current blends are priced at near-parity to 0.1% MGO. In addition, the quantities available (whether delivered or ex-wharf) are a major uncertainty. The IEA assumes 1m barrels per day of bunker demand will move to 0.5% VLSFO (out of a total bunker demand of 4m bpd) – i.e. 25% of future bunker demand will come from new compliant fuels. LNG has been touted as a potential solution, however even with a high prediction on the number of LNG vessels (600 by 2020 – source: DNV GL) it still remains at <1% of total bunker demand. As a result, 68% of bunker demand has to be fulfilled by 0.1% MGO – more than double what it is now. The increase in 0.1% MGO bunker demand:

With refining capacity already strained and distillate yields at near-max levels, it’s likely to result in an increase in 0.1% MGO price by at least $120/mt in order to compete with other end consumers and incentivise higher refinery output. This would cause the total spread between HSFO-MGO to be $680/mt creating a large incentive for both shipowners and suppliers to find a solution. Although an increasing price differential between 3.5% HSFO and VLSFO/MGO may significantly decrease the theoretical payback time on a scrubber, there are larger issues and areas of uncertainty. 3.5% HSFO is typically sourced from the Baltics or Caribbean and then transported to Singapore via VLCC. The East-West (Rotterdam vs Singapore 380cst price) typically trades at $20-30/mt to cover this freight cost. Will there still be incentive for this arb to be open with a low 3.5% HSFO price and extremely uncertain demand volumes? Furthermore, the cargoes are then stored, broken down and sold ex-wharf in small lots to barge operators: will there still be barge suppliers dedicated to delivering 3.5% HSFO fuel? Given the recent bad press about open-loop scrubbers, closed-loop scrubbers are likely to be the only option. This means ships will need chemical additives onboard, plus a sludge removal plan which can complicate operations and increase costs. 34 industry leaders from companies such as Maersk, Cargill and Trafigura this week committed to zero-carbon emission fuels by 2030. This surfaces another big question: will scrubbers again have to change, especially with space on-board already constrained? BunkerEx, a company focused on technology solutions for bunker procurement has already seen demand from shipping companies for EUA, CER and VER Carbon Credits as a hedge against upcoming regulations. As the supplier landscape changes, existing products will need to find new homes and prices. 3.5% HSFO will find its way to power generation and storage from refineries who have to produce it (this might be good for dirty tankers as floating storage). Existing flows of 3.5% HSFO will likely stop. 3.5% HSFO barges will likely switch to 0.5% VLSFO or 0.1% MGO. 0.5% VLSFO will be attractive based on its price differential to 0.1% MGO. However, this has key ‘known unknowns’ such as specifications (currently no standards) and stability (can two different types of 0.5% VLSFO fuel be mixed?). 0.1% MGO will likely be the dominant bunker fuel of choice however refinery supply restrictions will make this much more expensive. Fuel efficiency will be key as bunker prices rise. LNG, although much talked about will likely account for <1% of demand in 2020. Its impact will likely be felt closer to 2030 as many newbuild ships have dual fuel engines and the supply network has time to mature. With rising fuel prices, BunkerEx records calorific values of all fuel supplies to monitor variations between suppliers, ports and fuel types. This assists in assessing the true energy cost to shipping companies and can be compared on a MJ/$ basis. |